EVALUATION

The first step to the successful sale of an insurance agency is an objective evaluation of its strengths and weaknesses by a competent professional specializing in insurance agency business sales.

Agency owners often have trouble establishing realistic selling prices. Wishful thinking may sometimes produce inflated prices. On the other hand, some owners tend to understate the value of their agencies.

When operating a business, it is sometimes thought to be prudent to minimize reported earnings and reduce taxes. But when selling a business, prospective buyers must see a true picture of its profitability and cash flow.

A thorough business evaluation can include scrutinizing the financial statements to establish the actual available cash flow by eliminating excessive owner compensation, perks, nonessential and nonrecurring expenses and owner's debt service. Assets, both apparent and hidden, must be assessed and restated to reflect true values.

The evaluation should analyze other factors such as competition, market position, insurance carrier representation, customer base, employees and improvement potential.

The final price and terms of a sale will be developed using all of the data contained in the Evaluation.

The analysis of the MKL Acquisitions Team can help you decide how much you want to sell your Agency for in today’s insurance market.

back to top

WHO CAN I TRUST?

The MKL Acquisitions Team are experienced Business Brokers. As such we pride ourselves in our professionalism and performance. We honor your confidentiality and work hard at closing your transaction for you. We will not accept an engagement (listing) unless we feel strongly that we can help you achieve your goal of selling your insurance agency at the price you want.

back to top

WHAT IS THE COST?

MKL offers 3 Options to help you decide how we help you sell your business

MKL offers 3 Options to you that give you the flexibility to determine what exactly your cost will be to sell your Agency at the price you feel its worth!

back to top

CAN I SELL IT CONFIDENTIALLY?

Can I sell my Agency without my employees, my customers and my markets (suppliers) knowledge?

Absolutely! Everything we do at MKL Acquisitions is done to protect you and your business from anyone finding out that you have decided to market your business until such time as a transaction is in the final stages of the process.

back to top

WHAT IS THE PROCESS LIKE?

The MKL Acquisitions Team meets with the business owners and asks a multitude of questions and combines this with their experience and research designed to allow the MKL Acquisitions Team to get to the answer of this one important question:

1. Is this business saleable; and if so, at what price?

back to top

DO I HAVE TO DEAL WITH EVERY BUYER?

Screening potential buyers is one of the most important benefits a Business Broker like the MKL Acquisitions Team can provide for you. Keep in mind that roughly 90 percent of those who respond to business-for-sale ads are either not serious buyers or are not financially qualified. By screening prospects, the business broker will contribute to confidentiality by limiting the exposure of the business to the most promising buyers instead of the merely curious time-wasters.

back to top

CANDIDATE SEARCH

Confidentiality is of primary concern in searching for sellers or buyers. A seller generally cannot prospect for buyers without revealing their identity. They often make the mistake of turning to people they know within the insurance industry. Despite efforts to keep things confidential, the owner’s intention all too often becomes common knowledge.

Sellers do not always have ready access to qualified buyers. Neither do buyers always have access to interested sellers. There are typically far more buyers than there are profitable insurance agencies for sale. We can provide optimum access to both buyers and sellers while still maintaining strict confidentiality.

Selling your business is not something that will happen overnight. This is a sensitive complex process that when done right not only finds you the RIGHT business buyer, but also protects you from worrying about the sale being disclosed to your employees, suppliers, customers, clients, patients and competitors prior to the time it is necessary for them to know. The MKL Acquisitions Team works hard to maintain your trust and does not waste your time with unqualified buyers.

back to top

PRE-QUALIFICATION

Separating qualified buyers and sellers from the mildly curious is an art mastered only by the experienced specialist. Buyers and sellers coming to MKL Acquisitions are thoroughly interviewed before the identity and any specific information about a buying or selling agency are revealed.

back to top

INTRODUCING THE BUSINESS

Introducing a prospective agency buyer to an agency seller business involves a great deal of expertise in pre-qualifying both parties. Both buyer and seller must gain a feel for the business of the other by viewing an operation firsthand and by discussing its many facets. Our role as an intermediary of utmost importance at this point, as we assist in discovering and addressing any concerns that a buyer or seller might have.

back to top

NEGOTIATIONS

Once a buyer and seller signals an interest to move forward, the most critical step in the selling process begins. Some proposed business sales never close because of relatively minor stalemates in negotiating. Even some deals which do close falter during the negotiation process. Our communication and people skills will serve to keep a good deal going when it might otherwise lose momentum. Our skilled use of the following major aspects of the art of negotiation will benefit both buyer and seller:

a. Mediation: Negotiating an insurance agency sale is an arduous, emotional process. As face-to-face confrontations progress, sellers and buyers sometimes become less flexible. They may become more concerned with holding their positions than with finding a common ground.

MKL Acquisitions serves a vital role as a third-party mediator. Instead of focusing on dollar amounts or other areas of disagreement, we encourage the parties to concentrate on their primary areas of compatibility and the development of a mutually beneficial agreement.

b. Deal Structuring: Technical expertise, flexibility, and creativity are the key components necessary to develop an approach that is economically feasible for both parties. Of all the elements of a business sale, structuring the transaction can be the most difficult and the least understood. The following are representative samples of some of the various deal-structuring factors which may be considered:

|

· E. B. I. T. D. A.

· Stock Redemption

· Asset Purchase

· Stock Purchase |

· Non-Compete Agreements

· Cash Flow

· Seller Financing

· Profit Sharing |

· Personal Guarantees

· Consulting Contracts

· Multiples of Commission

· Lifetime Commissions |

c. Issue Resolution: Throughout the negotiation process some areas of disagreement invariably arise. Because of our experience and sensitivity to this problem, we anticipate and help resolve issues before they become deal breakers

back to top

LEGAL & ACCOUNTING

In order to best protect your interests, the involvement of your legal and accounting professionals is a critical part of buying and selling an insurance agency. MKL Acquisitions does not profess to be qualified to advise either a buyer or seller on legal or accounting matters. We work with your legal and accounting professionals to assist in providing them with the available information that will allow them to advise you properly.

back to top

CLOSING & FOLLOW UP

MKL Acquisitions will provide a written summary of the terms being discussed by the buyer and the seller. This summary will be made available to the buyer's and sellers professional advisors, to assist them in reviewing all aspects of a potential agreement, as well as giving them a basis from which to prepare a draft copy of a written contract.

During the immediate months after the closing of any deal between buyer and seller MKL Acquisitions will endeavor to stay in touch with both parties in order to determine the mutual compliance with all terms of the deal. Any open areas of concern will be addressed in the hope of resolution of any differences.

back to top

HOW LONG DOES IT TAKE?

Selling your business is not something that will happen overnight. This is a sensitive complex process that when done right not only finds you the RIGHT business buyer, but also protects you from worrying about the sale being disclosed to your employees, suppliers, customers, clients, patients and competitors prior to the time it is necessary for them to know. Let The MKL Acquisitions Team help you achieve the biggest sale of your business career! Call: (855) 343-5544 - www.Agency-Broker.com

===================

Many Insurance Agency Owners have at one time or another thought about selling their insurance agency or brokerage. Many were tempted but never quite took the plunge. Those who didn't sell most likely were making too much money at the time or decided to sell later but didn't know when.

Currently there are three major considerations that could or should be major drivers in reaching this decision: Capital Gains Taxes, Timing in Relation to Earnings and Desired Exit Planning.

Buyers are not interested in nice buildings or beautiful offices. Purely and simply, they are buying earnings, cash flow, growth potential and to a certain degree, management. It is historically true that a buyer's purchase price will also increase because of the ability to fulfill a specific need or niche. However, nothing consistently drives purchase price multiples up like high revenues and earnings (EBITDA).

The hard truth remains. When a business is at an earnings peak, assuming there is no significant debt, there is no better time to sell.

It is a well proven and many times documented fact that the best time to sell an agency or brokerage is during the time of peak earnings. It takes a shrewd and savvy business person to embrace this idea, to accept it as the sound strategy it is and to have the courage to act on it.

Selling an agency is probably not something an owner has a great deal of experience doing. A good merger & acquisition investment banker lives, sleeps and eats the process every day. An insurance specific M&A firm will lead him smoothly through the complex preparation and selling process with the knowledge and experience required to avoid most of the potholes along the way.

Getting a valuation done for his or her business is the equivalent of sticking a toe in the water. With accurate information supplier by the owner, a qualified advisor can value a business properly.

Once the valuation is completed and the owner has a good idea of the general market value of the agency, if he/she wishes, the process can move forward.

The decision to sell is probably the most important decision the owners of a company will ever make. It is a difficult business decision, colored by financial, marketing, legal, tax, and insurance agency valuation concerns. It is also a difficult personal decision under any circumstances. We fully appreciate the sensitive business and personal issues involved when a company changes hands. We strive to address these issues and to complete the sales transaction successfully, with as little disruption as possible throughout the process.

Let's assume that you are a seller seeking to cooperate with MKL Acquisitions efforts to arrange for the sale of your insurance agency. Following is the typical scenario of events:

- We begin by defining your objectives, including financial issues, as well as personal concerns - the question of your continued involvement in your company, for example, or anxiety about the outcome for critical employees. Then we conduct an in-depth review of your company and its position in the market. This may include details pertaining to the type of insurance provided, market representation, the premium volume, commission levels, loss ratios and so forth.

- You will be advised that MKL Acquisitions is employed and compensated by a potential buyer, but that MKL Acquisitions deals honestly and fairly with all parties to a transaction. The seller will be asked to sign the Seller Confidentiality Agreement, stating that the seller will not share any financial information provided to the seller by the buyer with any person not specifically involved in the transaction.

- MKL Acquisitions will develop and meet with any potential buyers and for any likely candidates. We will develop a buyer history, along with obtaining background and financial information.

- After a potential buyer candidate is developed for you MKL Acquisitions will meet with the buyer and ask buyer to sign a Buyer Agreement, which is the formal compensation contract between the buyer and MKL Acquisitions. We will also ask buyer to sign the Buyer Confidentiality Statement, indicating that buyer will not share any financial information provided to the buyer by the seller with any person not specifically involved in the transaction.

- The seller, the buyer and MKL Acquisitions will meet in person and if it is deemed appropriate background and/or financial information will be exchanged between the parties.

- If it is determined that a sale or any other sort of business affiliation is to be pursued, a strategy will be developed as pertains the valuation of the seller's business. Values can be determined by employing a number of different methodologies, including the use of formulas such as multiples of commission or Earnings Before Interest Taxes Depreciation and Amortization (E. B. I. T. D. A).

- MKL Acquisitions will continue the dialogue with the buyer and the seller and will serve as intermediary for any communication between each of the parties. MKL Acquisitions will arrange for additional meetings, as warranted, between the buyer and the seller, until such time as an understanding of the general terms of a sale are agreed upon.

- MKL Acquisitions will present any offer from the buyer to the seller.

- If an offer is accepted by the seller, MKL Acquisitions will continue to work with both the buyer and the seller on an ongoing basis to arrange with their accounting, tax, legal and insurance agency valuation professionals to put together a final contract for signature.

- At the time of closing the buyer will be responsible for payment to MKL Acquisitions, in accordance with the terms set forth in the Buyer Agreement.

- After the closing MKL Acquisitions will endeavor to periodically contact the buyer and the seller in order to determine final satisfaction with their agreement, as well as to offer additional services that may be of assistance.

back to top

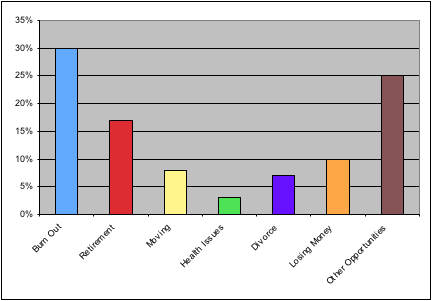

REASONS PEOPLE SELL

| Burn Out |

30% |

|

| Retirement |

17% |

| Moving |

8% |

| Heath Issues |

3% |

| Divorce |

7% |

| Losing Money |

10% |

| Other Opportunities |

25% |

| |

|

|

|